Turnover numbers are a great way to market your company to stakeholders and potential investors. Profit grounds you, and adds a dose of reality. But cash flow gives you a cold, hard look into how well your company is doing. Let’s get specific. Here’s a list of benefits of keeping close tabs on your cash flow statement.

Staying ahead of your debt

You apply for loans to finance expenses like buying equipment or property, upgrading infrastructure, or paying off other loans. When you apply for a loan, what you’re doing is using your future cash flow to meet a current need. Keeping track of negative cash flow—whether monthly or daily—removes the false sense of security that loans typically create, and paints a clearer picture.

Ensure Liquid Assets are Available

Your cash flow statement is a crucial aid that helps you keep short-term planning well managed. It helps you exercise control over liquid cash. Every business—whether a restaurant chain or a construction business-needs to have liquid assets on hand. You never know when a sudden necessity might strike. Unexpected weather conditions is an example of a reason to use liquid funds. A piece of equipment—that you bought cheaper, without a warranty—might break down years ahead of schedule. In both situations, you need cash on hand to get your business back on track.

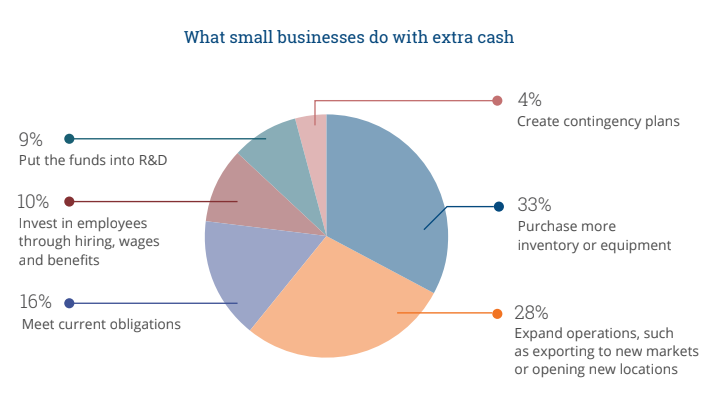

For this reason, an essential component of short-term planning is making sure you always have a backup for contingencies.

Insights Into your Company’s Spend

Cash flow provides a precise look at your financial status. Some payments only impact your cash flow statement—not the profit and loss statement. A cash flow statement improves transparency into your finances and spending habits, keeping you informed on the actual state of play. Without a cash flow statement, you might be under the illusion that profit you make means a boost in finances.

Optimize your Cash Balance & Control over Working Capital

To learn these other important reasons to understand your cash flow and obtain tools to help with cash flow management, download our guide today!