For many small business owners the financial aspects of the business are things they’ve had to learn on the fly. Liquidity, solvency and other financial terms can be overwhelming and confusing especially when they are being addressed during times of financial hardship or stress. We’ve created this handy infographic to help individuals better understand what these ratios are and how to put them together.

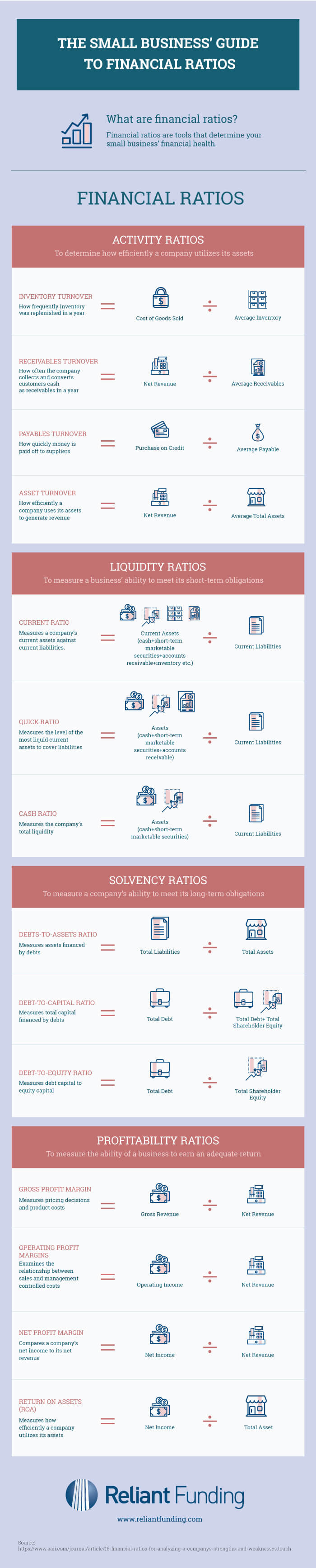

The Small Business’ Guide to Financial Ratios

What are financial ratios?

Financial ratios are tools that determine your small business’ financial health.

Financial Ratios

Activity Ratios: To determine how efficiently a company utilizes its assets

Inventory Turnover: How frequently inventory was replenished in a year

Receivables Turnover: How often the company collects and converts customers cash as receivables in a year

Payables Turnover: How quickly money is paid off to suppliers

Asset Turnover: How efficiently a company uses its assets to generate revenue

Liquidity Ratios: To measure a business’ ability to meet its short-term obligations

Current Ratio: Measures a company’s current assets against current liabilities

Quick Ratio: Measures the level of the most liquid current assets to cover liabilities

Cash Ratio: Measures the company’s total liquidity

Solvency Ratios: To measure a company’s ability to meet its long-term obligations

Debts-to-Assets Ratio: Measures assets financed by debts

Debt-to-Capital Ratio: Measures total capital financed by debts

Debt-to-Equity Ratio: Measures debt capital to equity capital

Profitability Ratios: To measure the ability of a business to earn an adequate return

Gross Profit Margin: Measures pricing decisions and product costs

Operating Profit Margins: Examines the relationship between sales and management-controlled costs

Net Profit Margin: Compares a company’s net income to its net revenue

Return on Assets (ROA): Measures how efficiently a company utilizes its assets