If you’ve been noticing your bills getting too hard to handle lately, it may be time to check on your business’s financial health. The easiest way to check the temperature of your business is by calculating some simple financial ratios.

Although most business owners wait until the end of the financial year to do a Financial Health Analysis (FHA). A periodic analysis will help you understand how close your business is to achieving its short-term and long-term goals. It also reveals any financial commitments to take action on before the year ends.

Is your Business Generating Consistent Profit?

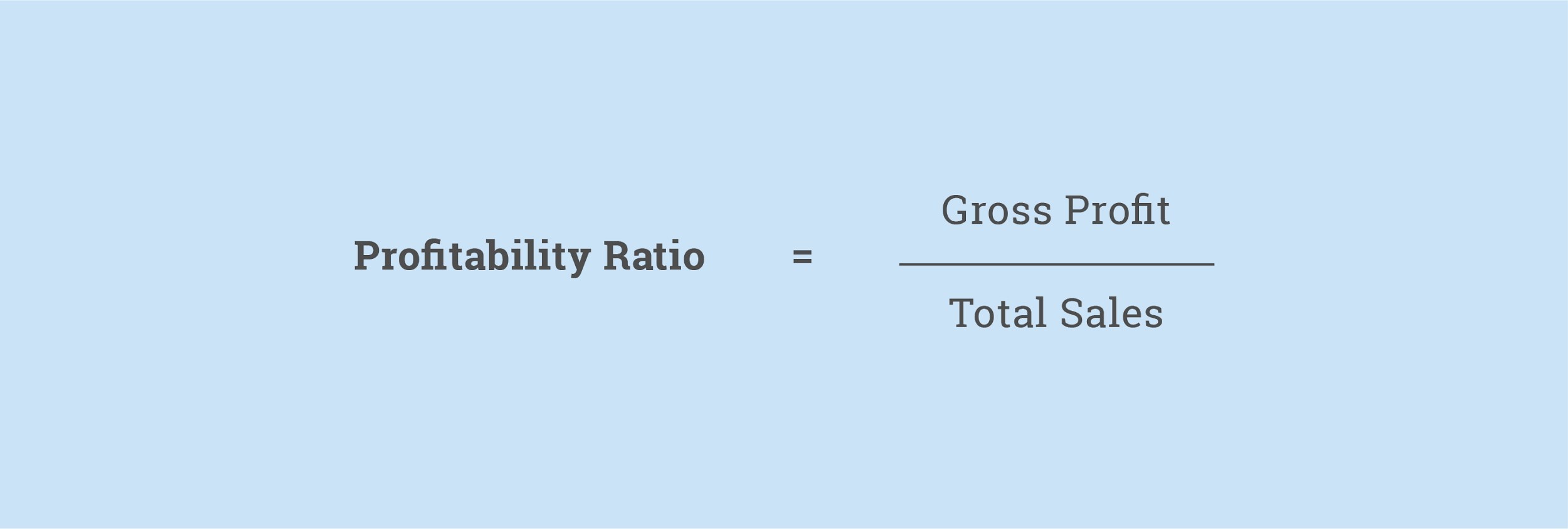

Most business owners may be under the assumption that just because they’re making great revenue, they’re probably making a good profit as well. Without accounting for overhead costs, and any invoices you owe your vendors, you’ll never be able to judge how successful your business actually is. Checking if your business is consistently able to generate a profit is one of the most important ways to measure its viability.

The profitability ratio measures your overall business performance. Compare this number with other businesses in your industry to see if your business meets the mark.

Can your Business Meet Short-Term and Long-Term Obligations?

Even if your business is generating a good profit, it’s not an individual entity, uninfluenced by factors around it. Sudden market-shifts, new industry or government regulations and even natural disasters can affect your business, making it incapable to meet obligations and goals. Your business should be financially prepared for these situations, and not let them deter you from any of your goals or commitments. With the onset of Hurricane Dorian for instance, several businesses in Florida had to adopt a flexible supply chain and adapt to sudden demand surges.

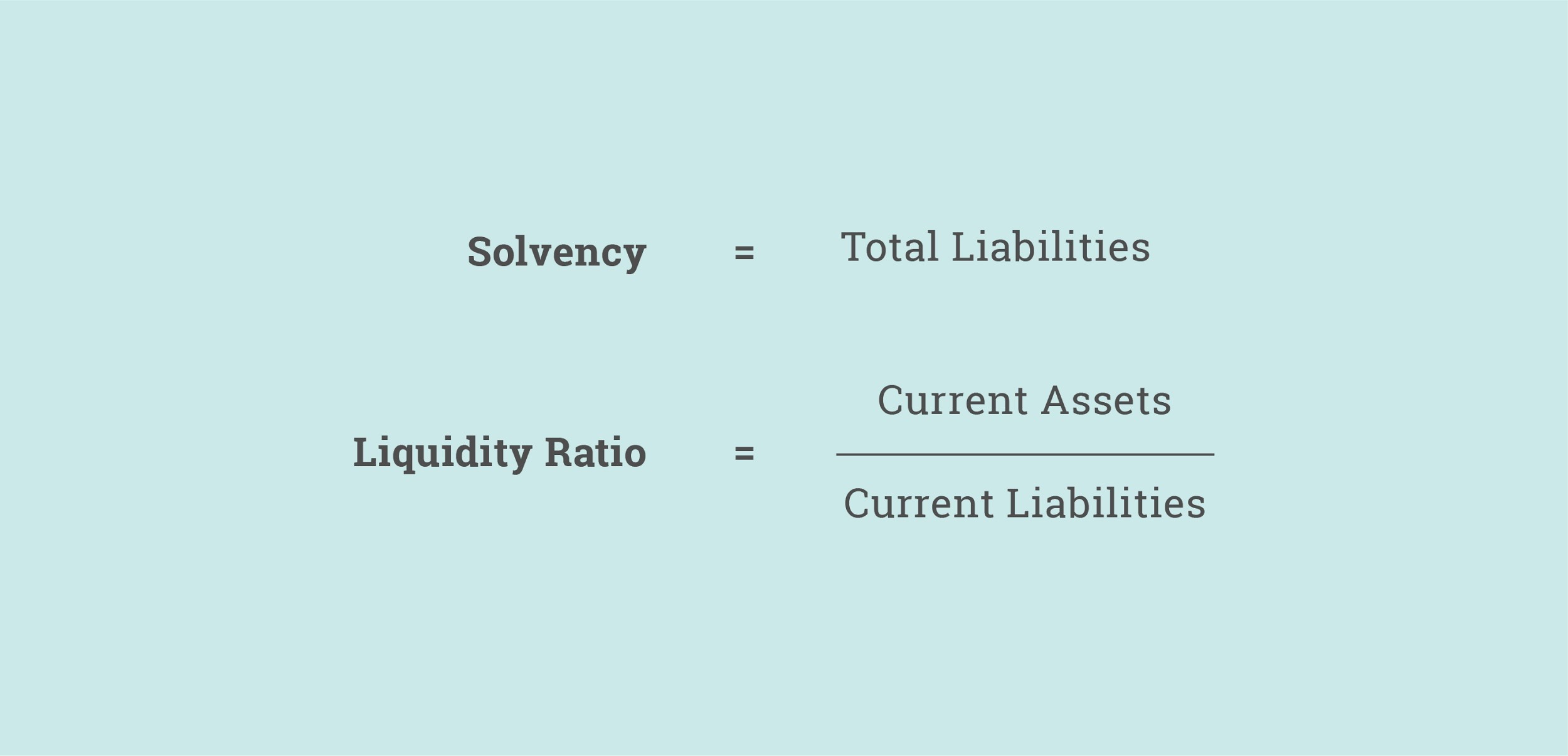

A liquidity ratio measures whether your business has enough to meet all bills and dues, with extra for emergencies. A generally acceptable ratio is 2:1 but this can vary according to the industry and business. It’s advisable to have a ratio higher than the industry average, just so you’re better prepared.

While liquidity generally takes cash flow into account, the solvency ratio answers if a business will still be able to meet all its debts and obligations even in the case of reduced cash flow. Hence, the ratio measures the business’s ability to meet these.

Is your Inventory Spending Balanced?

It’s not easy to make money without spending any. Learning how to maintain an inventory balance is crucial to all business owners. Stocking up on too much inventory might make your customers happy, but not only would it cut into your profits, it would also take up valuable physical space. This results in subsequent holding costs. Insufficient inventory can cause you to miss out on potential opportunities.

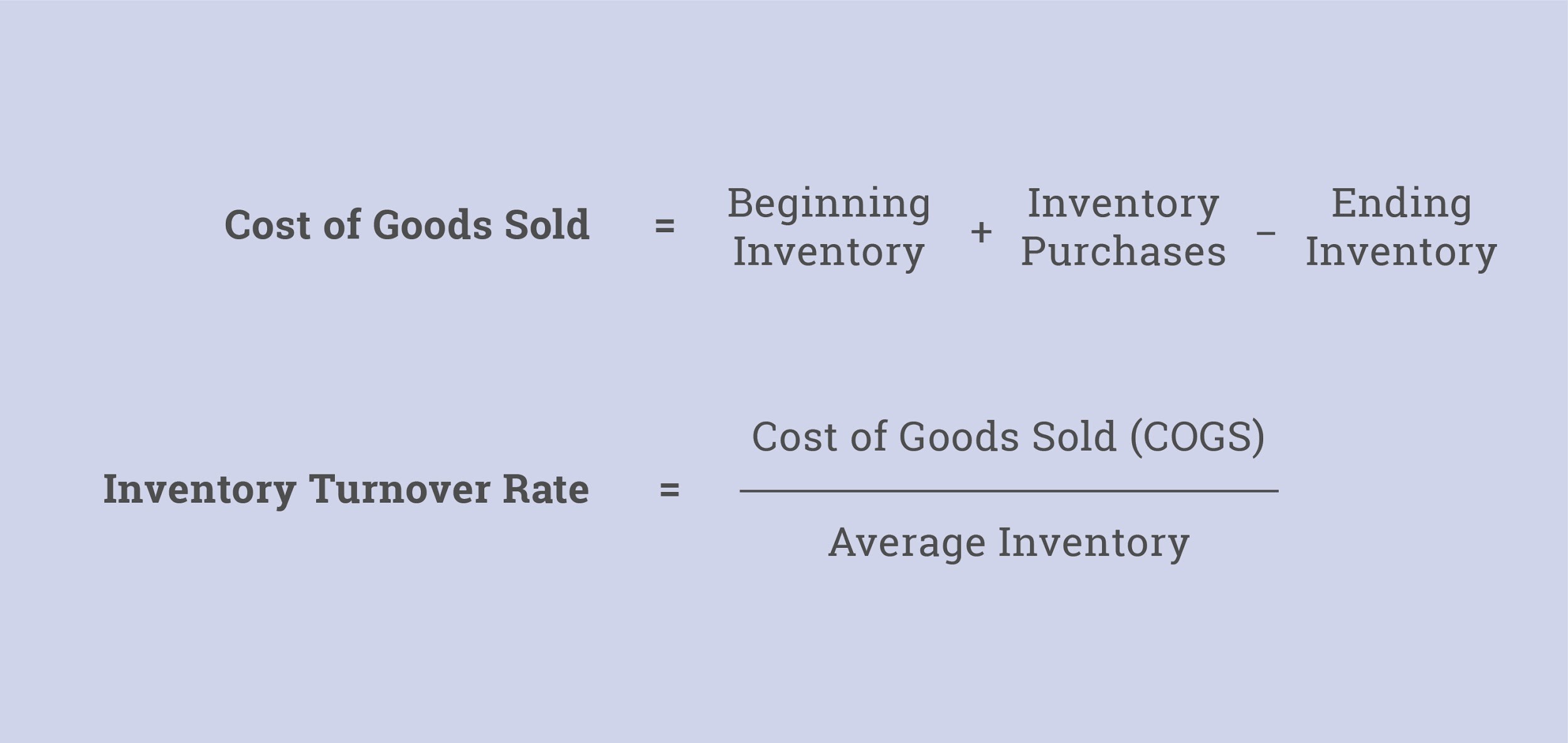

The Cost of Goods Sold (COGS) can help you understand the bigger picture of your business’s financial performance, assess the profitability of your inventory and reassess your product pricing. Ultimately, it helps you decide how much money your business needs to invest in inventory.

The inventory turnover rate measures the number of times a product is sold or consumed in a specific time period. Not only does this number tell you how much stock of each product you should keep, it also helps you determine any costs incurred when the product doesn’t sell. The inventory ratio depends on two aspects of your business’ performance; purchasing and sales. If you purchase too much inventory, you may need to sell more of it to meet a good turnover rate. Your sales also have to match your inventory purchases, for inventory to turn effectively.

Are you Reinvesting Enough for Growth?

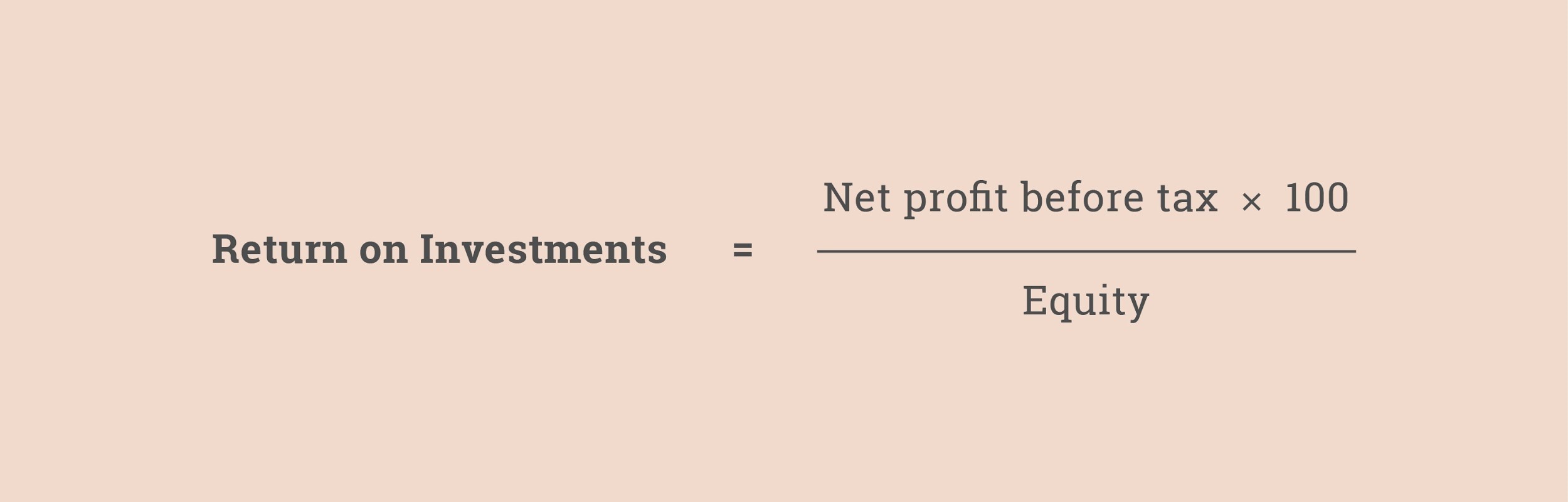

Your business’s return on investment can help you determine whether the efforts that you’re putting into it are making appropriate and worthwhile returns based on equity. This number also answers whether your assets are being efficiently used. For instance, a ratio lower than the industry average means your business assets are not being used to their full potential. Ultimately, the best way to grow your business is to reinvest profits back into assets that will help grow your business. If your assets aren’t providing great returns you may need to revisit your business strategy.

In case your business isn’t making enough profits to invest in the assets your business needs, but currently can’t afford, you may want to consider an alternative short-term financing option that can give your business a little nudge in the right direction.

As a business owner, it’s never easy to handle every-day responsibilities, financial accounting, providing customer experiences and still putting aside the time to check your business’s financial health. However, there’s something to be said for the long-term advantages your business has to gain when you periodically review your goals, analyze opportunities for growth and have a succession plan in place for your business. A quick financing solution from Reliant Funding can help keep your business ahead of the competition.